Life is unpredictable, and one of the most stunning approaches to ensuring your loved ones are financially protected is through life insurance. Whether you’re contemplating it strangely or hoping to deal with your money related security, life insurance offers a strong prosperity net for your friends and family. In this total associate, we will explore what life insurance is, its different sorts, why it’s critical, and the way that it can give genuine serenity. This article will moreover help you with understanding how to pick the most brilliant methodology for your prerequisites and how life insurance can fit into your by and large money related plan.

What is Life Insurance?

Life insurance is an understanding between an individual (the policyholder) and an insurance association. As a trade-off for standard charge portions, the insurance association promises to pay a foreordained measure of money, called a destruction benefit, to the policyholder’s beneficiaries when they bite the dust. This single sum is ordinarily used to take care of expenses, for instance, entombment administration costs, exceptional commitments, and regular expenses for the family deserted.

How Does Life Insurance Work?

The key mechanics of life insurance are immediate:

You pay expenses: These can be month to month, quarterly, or yearly.

The fall back covers your life: As long as you continue to pay your costs, the insurance stays dynamic.

Your beneficiaries get a payout: Upon your passing, the contingency plan pays a solitary add up to individuals (ordinarily family members) you doled out as beneficiaries.

There are in like manner methodologies that assemble a cash regard for a really long time, which the policyholder can get against or haul out during their lifetime.

why Do You Have any desire for Life Insurance?

The request “Do I genuinely need life insurance?” is ordinary. The reaction depends upon your circumstances, yet life insurance offers a couple of key benefits, including:

Money related Insurance for Your Loved ones

The fundamental benefit of life insurance is the money related security it provides for your wards. Whether it’s to take care of regular expenses, contract portions, or long stretch plans like tutoring cost, life insurance can ensure your loved ones will not go up against financial trouble there of brain of your horrible passing.

Taking care of Last Expenses

Internment administration expenses can quickly add up. Generally speaking, families may not be financially set up for the costs related with end-of-life organizations. Life insurance can take care of these expenses, saving your family from the weight.

Dealing with Commitments

If you have basic commitments — like a home credit, Visa changes, or individual credits — your life insurance methodology can cover these so your family doesn’t gain the financial strain. Various families use their destruction benefits to deal with outstanding commitments after the policyholder passes.

Home Planning

If you’re considering inheritance organizing, life insurance can go about as a significant instrument. The end benefit gives liquidity, helping with covering space charges, probate costs, and other related costs, ensuring that your assets are conveyed by your longings without pointless deferments or financial hindrances.

Kinds of Life Insurance

There are a couple of kinds of life insurance procedures open, each planned to resolve different issues and conditions. Understanding the sorts of life insurance will help you with picking the best one for your situation.

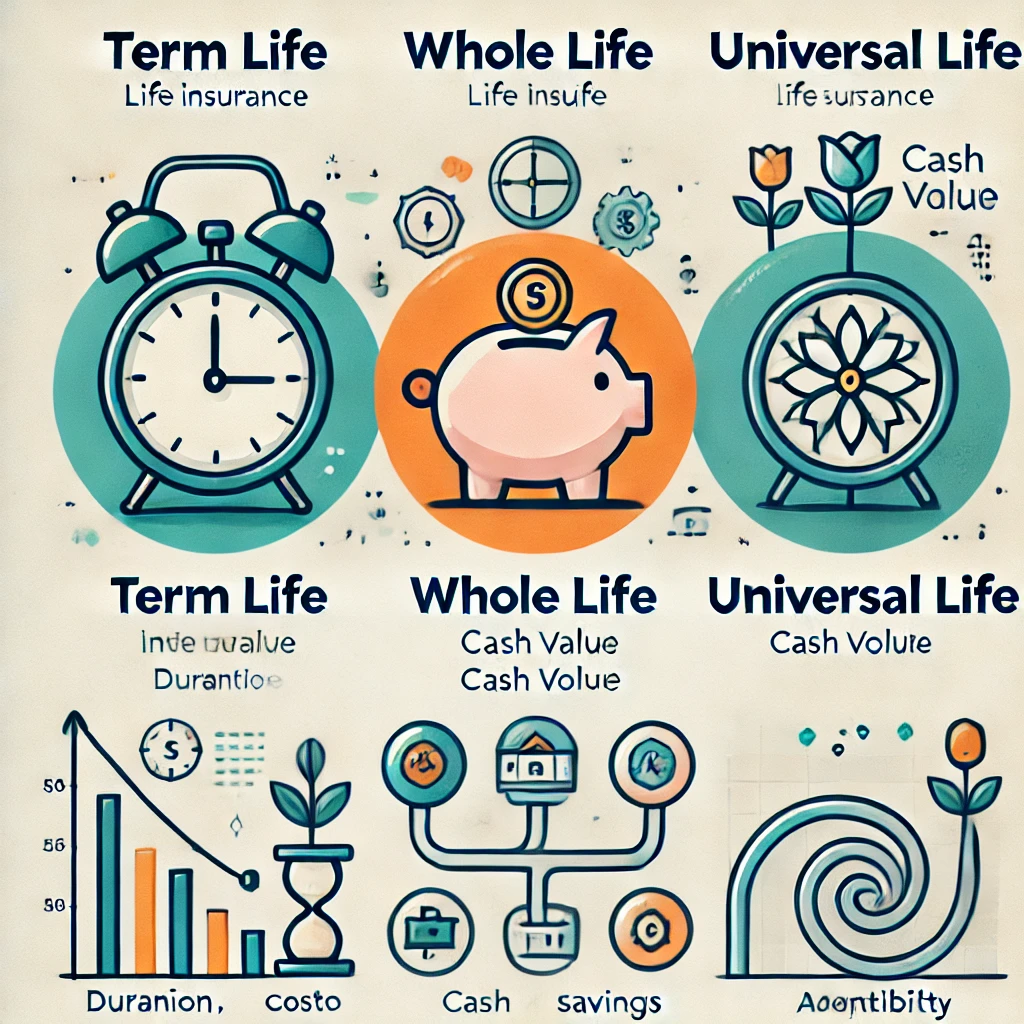

Term Life Insurance

Term life insurance is the most un-troublesome and most sensible kind of life insurance. It gives consideration to a specific period, regularly 10, 20, or 30 years. Accepting that the policyholder passes on inside the term, the underwriter pays the downfall benefit. If the term slips and the policyholder is at this point alive, the system closes with no payout. Also, read Best Life Insurance to gain more knowledge.

Best for: People looking for sensible incorporation for a set period (e.g., until a home credit is paid off or youths are created).

Experts: Low costs, clear.

Cons: No cash regard and no payout after the term slips.

Whole Life Insurance

Whole life insurance is a sort of dependable life insurance that covers the policyholder as far back as they can recall, for whatever length of time charges are paid. Despite the passing benefit, whole life insurance game plans total cash regard after some time, which can be gained against or used as a hypothesis instrument.

Best for: People looking for lifelong incorporation with a theory part.

Virtuosos: Guaranteed payout, cash regard gathering.

Cons: Higher charges than term life insurance.

General Life Insurance

General life insurance offers versatile costs and a cash regard part that creates considering the wellbeing net supplier’s endeavor execution. It licenses policyholders to change their charges and ignoring benefits the lifetime of the methodology.

Best for: Those searching for versatility in premium portions and passing benefits.

Aces: Versatile incorporation, cash regard advancement.

Cons: More stunning and routinely more expensive than term life insurance.

Last Expense Insurance

Generally called internment insurance or remembrance administration insurance, last expense insurance is a kind of whole life insurance planned to take care of end-of-life costs like dedication administrations, cremations, and specialist’s visit costs. It offers a more unassuming passing benefit, usually some place in the scope of $5,000 and $25,000.

Best for: Individuals expecting to cover internment administration and related costs.

Aces: Sensible, easy to meet all prerequisites for.

Cons: Lower death benefit stood out from various types of life insurance.

How to Pick the Right Life Insurance Methodology

Picking the right life insurance technique can be overwhelming, yet there are a couple of basic factors to consider while going with your decision.

Overview Your Money related Necessities

To what lengths life insurance consideration you will go for depends upon your money related situation. Consider how much commitment you have, your family’s regular expenses, and any future financial responsibilities (like tutoring cost or retirement). An essential rule of thumb is to enjoy a passing benefit worth 10 to numerous times your yearly compensation.

Ponder Your Spending plan

Different sorts of life insurance go with various retail costs. If you’re on a restricted monetary arrangement, term life insurance may be the best decision as a result of its lower charges. Regardless, if you want a technique that assembles cash worth and offers lifelong consideration, a dependable system like whole life or general life may be an unrivaled fit.

Contemplate Life Insurance Associations

It’s essential for glance around and break down procedures from different fall backs. Look for associations with strong money related examinations and grand client reviews. Ensure the game plan you pick offers relentless charges and versatile decisions that suit your prerequisites.

Ordinary Life Insurance Dreams

There are various misinterpretations about life insurance that hold people back from getting it. Could we uncover irrefutably the most typical legends:

“Life Insurance is Unnecessarily Expensive”

Numerous people misinterpret the cost of life insurance. In fact, term life insurance is ordinarily shockingly sensible, especially for additional young individuals sound.

“I’m Unnecessarily Young for Life Insurance”

Purchasing life insurance when you’re energetic and sound is a significant part of the time the most monetarily wise decision. Costs are overall lower, and it ensures that your family is defended should the surprising happen.

“I Shouldn’t mess around with Life Insurance accepting for a moment that I’m Single”

Whether or not you have wards, life insurance can cover commitments, clinic costs, and commemoration administration costs, saving your family from financial loads. Moreover, a couple of systems can go probably as an endeavor gadget, offering cash regard that can be gotten to in the not so distant future.

Conclusion: Life Insurance is Basic for Money related Security

In the current unusual world, life insurance expects to be a fundamental part in protecting your family’s money related future. Whether you’re safeguarding your loved ones from commitment, taking care of end-of-life expenses, or building a hypothesis vehicle through durable life insurance, having areas of strength for a set up is a keen financial decision. Accepting at least for now that you’re questionable where to start, consider chatting with a financial expert or insurance expert who can help you with assessing your necessities and find a system that obliges your life situation. Placing assets into life insurance today will give you and your loved ones inward serenity for some other time.